Overtime Pay: New Rules from the US Department of Labor

Thank you to my friend, Wendy McClellan of Structure for Success, for allowing me to reprint this article.

Because of the recent Department of Labor ruling regarding the FLSA, I have been asking my clients the same questions repeatedly.

- Do you have employees who are currently on salary?

- Is their salary less than $58,656 annually?

- What are their job duties and title?

- Do you know about the new DOL (Department of Labor) Overtime ruling?

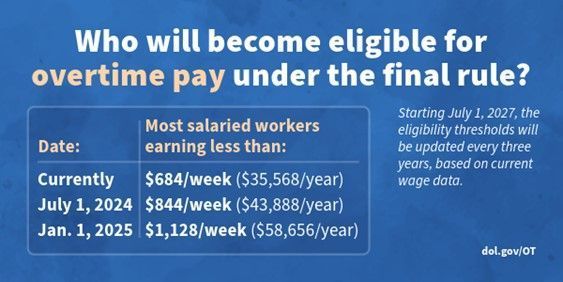

What new ruling you ask? On April 23, the DOL ruled that Fair Labor Standard Act (FLSA) required an increase in the annual salary-level threshold determining a worker's eligibility for overtime pay by 23.4%.

If you are reading this and saying “Huh?” Or if you have no clue if this applies to you. Or if you want to understand the changes you need to make with your workforce – keep reading. I am going to try and simplify it as much as I can. Remember this is only a brief summary. If you have questions, please reach out directly.

Who needs to comply?

The FLSA regulates essentially every employer which means every business owner with at least one employee must comply with the changes.

What are the changes?

- Effective July 1, 2024, workers who earn less than $43,888 (the minimum salary requirement) will need their employment status classified as a non-exempt employee, which means that they are eligible for overtime pay.

- Effective January 1, 2025, workers who earn less than $58,656 (the minimum salary requirement) will need their employment status classified as a non-exempt employee and are eligible for overtime.

- The next update will take place on July 1, 2027, and the salary threshold will increase again at that time.

Things to consider:

- Many employers think because they pay their employee on salary, the employee is exempt or ineligible for overtime pay. That is not accurate. You can continue to pay your employees a salary provided they are reclassified as non-exempt and they receive overtime pay for any workweek in which they work more than 40 hours.

- Simply raising your worker’s salary to the new limit will not necessarily meet the classification requirements.

- Simply changing the employee's title to "manager" or "supervisor" will not meet the new classification requirements.

What do I mean by that?

In addition to meeting the minimum salary requirement, a position must meet certain “specific duties tests” in order to be exempt from the overtime pay requirement. There are DOL websites where you can run the duties through and see if they qualify for an exception. Here are the two most common; there are other exceptions.

Executives:

These workers do not qualify for overtime pay if they meet the above minimum salary AND:

- their primary duty is “managing the enterprise or managing a customarily recognized department,” and

- they regularly direct the work of at least 2 or more other full-time employees, and

- they have the authority to hire or fire other employees.

Administrative Workers: These workers do not qualify for overtime pay if they meet the above minimum salary AND:

- their primary duty is “the performance of office or nonmanual work directly related to the management or general business operations,” and

- their primary duty includes “independent judgment with respect to matters of significance.”

Certain Positions are NOT eligible for salary or exemptions from the new overtime rule. If you are currently paying these employees on salary, you will need to reclassify them to hourly workers by July 1st and they will also qualify for overtime pay.

- Blue collar workers or manual laborers. These employees perform work involving “repetitive operations with their hands, physical skill and energy.”

- Inside sales employees

- Paralegals and legal assistants

- Most administrative assistants

Almost certainly there will be legal challenges to this DOL ruling, but that doesn’t mean you shouldn’t comply. This is not a “let’s wait and see” situation. If you do not comply with the new requirements, be prepared to pay hefty penalties. It isn’t worth jeopardizing your business. I recommend you begin these changes sooner rather than later and be ahead of the game.

Structure for Success is happy to help you with assessing your workforce. Please reach out and let’s see how we can help.

Structure for Success is a full-service Human Resources, Business Development, and Strategy consulting firm. Schedule a no-charge Discovery Call with Wendy McClellan at

www.structure4success.com.

NOTE: THIS ARTICLE IS FOR GENERAL INFORMATIONAL PURPOSES. IT DOES NOT CONSTITUTE LEGAL ADVICE, NOR DOES IT CREATE AN ATTORNEY-CLIENT RELATIONSHIP. EACH SITUATION IS DIFFERENT. YOU SHOULD CONSULT WITH AN ATTORNEY TO DETERMINE YOUR LEGAL RIGHTS, REMEDIES, AND DUTIES.

By Wendy M. Anderson, Esq.

Law Office of Wendy Anderson, PLLC